![]()

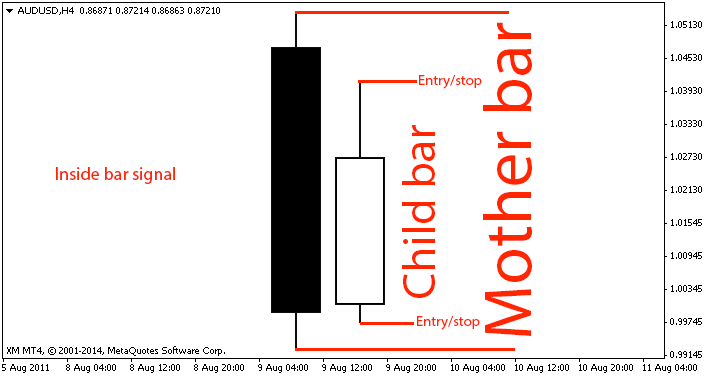

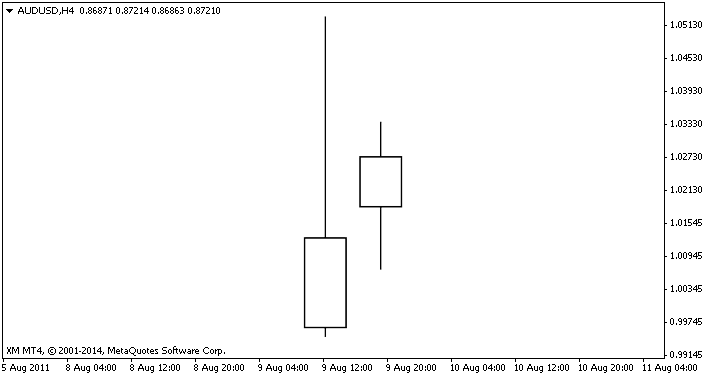

An inside bar represents a period of uncertainty in the market, neither the buyers or the sellers are willing or able to push the price in their direction and the bars will ‘stall’ and form a child bar or series of child bars, inside of the mother bar. When you get multiple inside bars, this is highly confirming the stall of the market. Once one side breaks the following breakout will likely be drastic and powerful.

Probability: As with all trading signals, true probability is down to your own ability and trading plan but a ball park if used with confluence is 65-85% win rate.

Probability: As with all trading signals, true probability is down to your own ability and trading plan but a ball park if used with confluence is 65-85% win rate.

Examples of inside bars

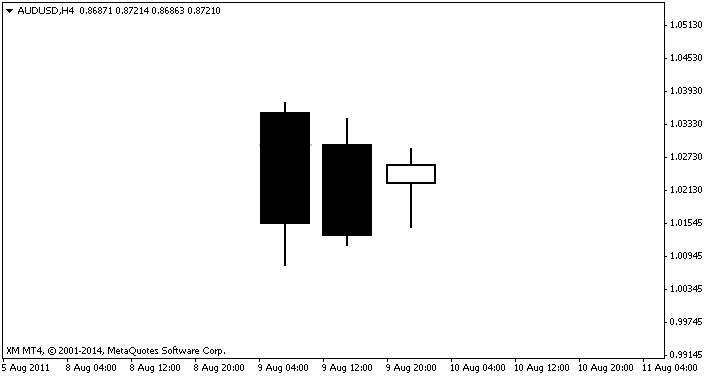

[The inside bar is made up of 2 candles, the mother bar and the child bar. The child bar can be in any position inside the mother bar high and low range]

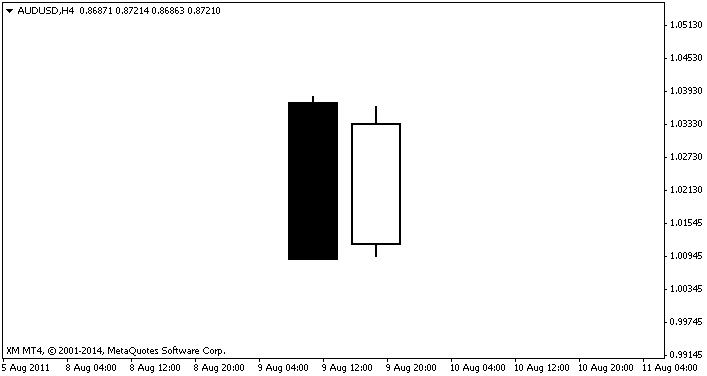

[A classic, tightly formed inside bar trading signal]

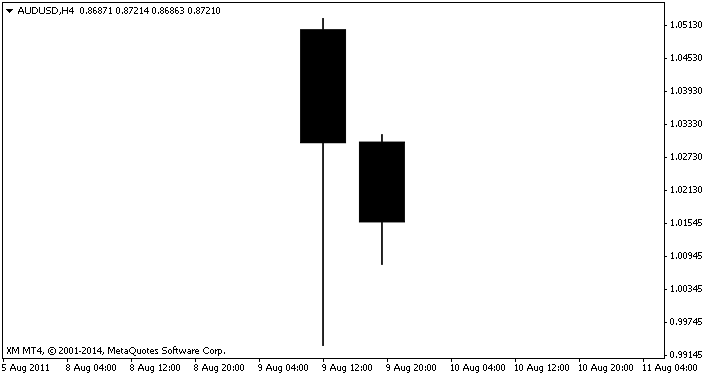

[The child bar can be anywhere inside the mother bar range, neither the mother bar or child bar has to have a full body for the signal to be valid]

[Inside bars with small real body’s are still perfectly valid. The range is the only important factor]

[Multiple inside bars are considered even more high probability, the more inside bars form inside each other, the more likely a very strong break out will occur]

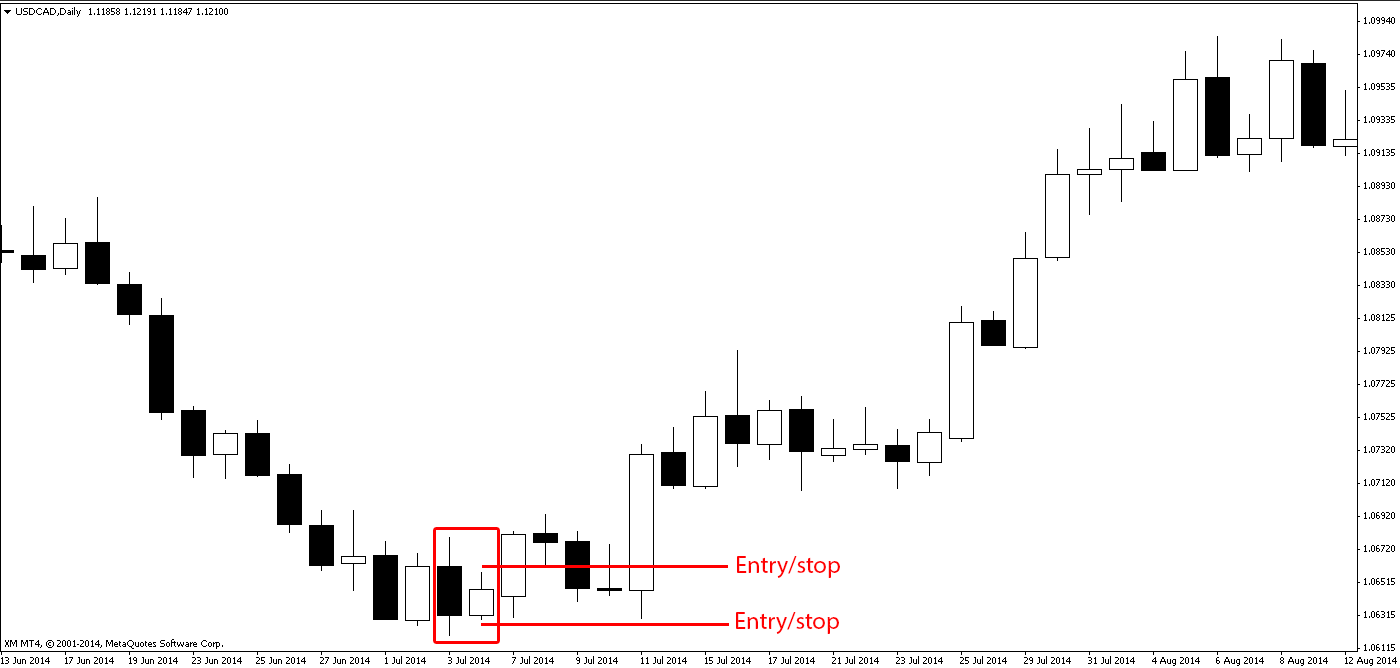

How to enter the inside bar

As there is no fail safe way to know which way the trade will go, so we place 2 orders at stop and entry positions. This way we don’t have to guess if the trend will hold, or reverse. We know the pattern will signal one or the other so we place orders for both 1 pip either side of the child bar high / low. To maintain as high a probability as possible, only trade in the direction of the dominant trend unless you are experienced.

The inside bar is a signal of indecision or consolidation, and the breakout direction dictates the winning party and direction of travel. The break out trade occurs when either the high or the low is broken. So if the high is broken we think the price will go up, so we buy. If the low is broken the bears have won the candle and price is likely to go down so we sell. The breakout is best used in a strong trending market, ideally at TSR confluence levels and in the direction of the market. So in an uptrend, if the inside bar is formed in the touch of the trend, you would aim to buy once the breakout of the child bar high is breached.

It may seem counter-intuitive that the indicator signals either a continuation or reversal, so it’s important to remember that whats causing the pattern is indecision in the market. Imagine a game of tug-o-war where both sides are deadlocked, there is extreme force being willed by both teams yet from a distance it would seem not much is happening. Once the will of a side is broken, they all fall over and the winners are free to move as they wish. This is just an analogy so you can remember what’s happening.

Inside bars with large mother bars decline in appeal the larger the mother bar gets, this is for two reasons, one it could be fluke (a large bar has a lot of room for another bar to form inside of it randomly) and two is you will need a very large stop loss which will decrease your risk reward. Tighter, more compressed inside bars are trades. The best way to tell is just practice, go and study some charts and develop your instinct for spotting good ones.

Inside bars are daily and 4 hour chart indicators, the lower time frames have far to much trading noise for these to develop into valid signals. IMO, although many people do trade them on lower time frames.

The advantage of inside bars is that they are high probability, and usually require a smaller stop loss than a pin hammer. Thus increasing your RR. However, they are not as high probability as a pin hammer but close.

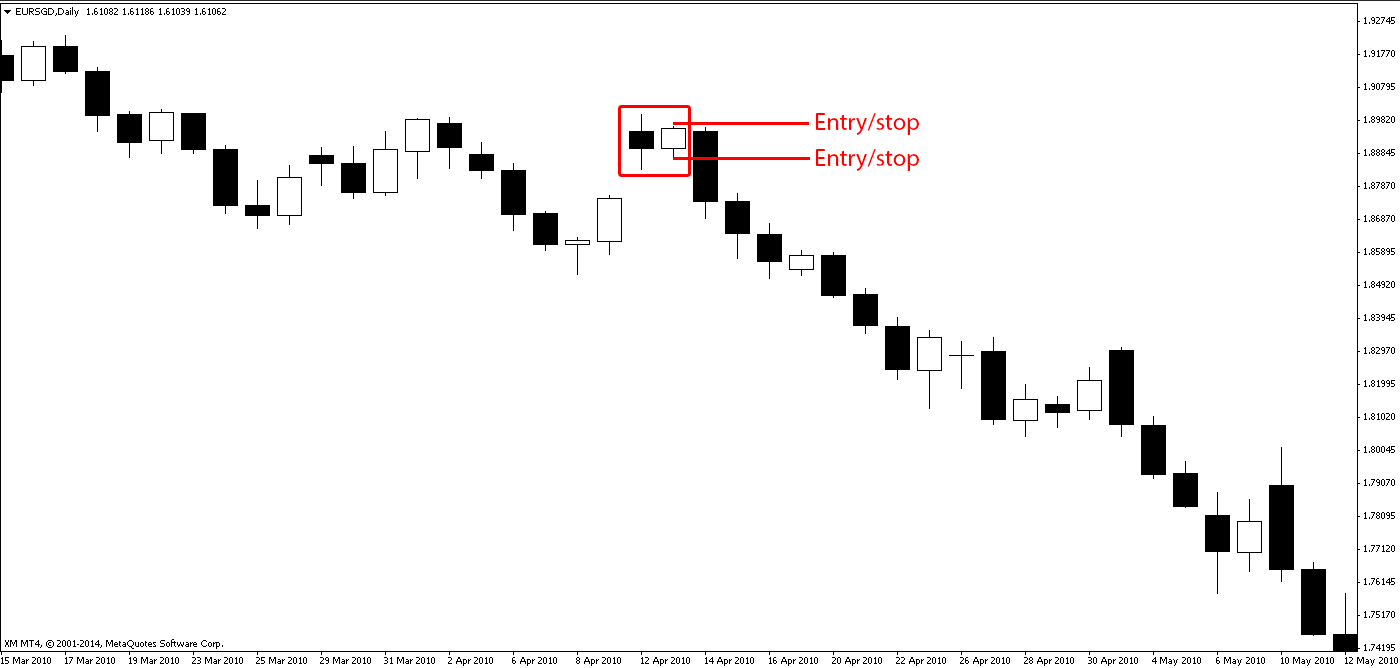

[Continuation breakout with very large risk reward, even if the trend had reversed you would have still had a winning position]

[Reversal breakout, tiny risk, massive reward]

[Reversal breakout, even if the trade had been a continuation you would have still won as you have two pending orders for both directions]

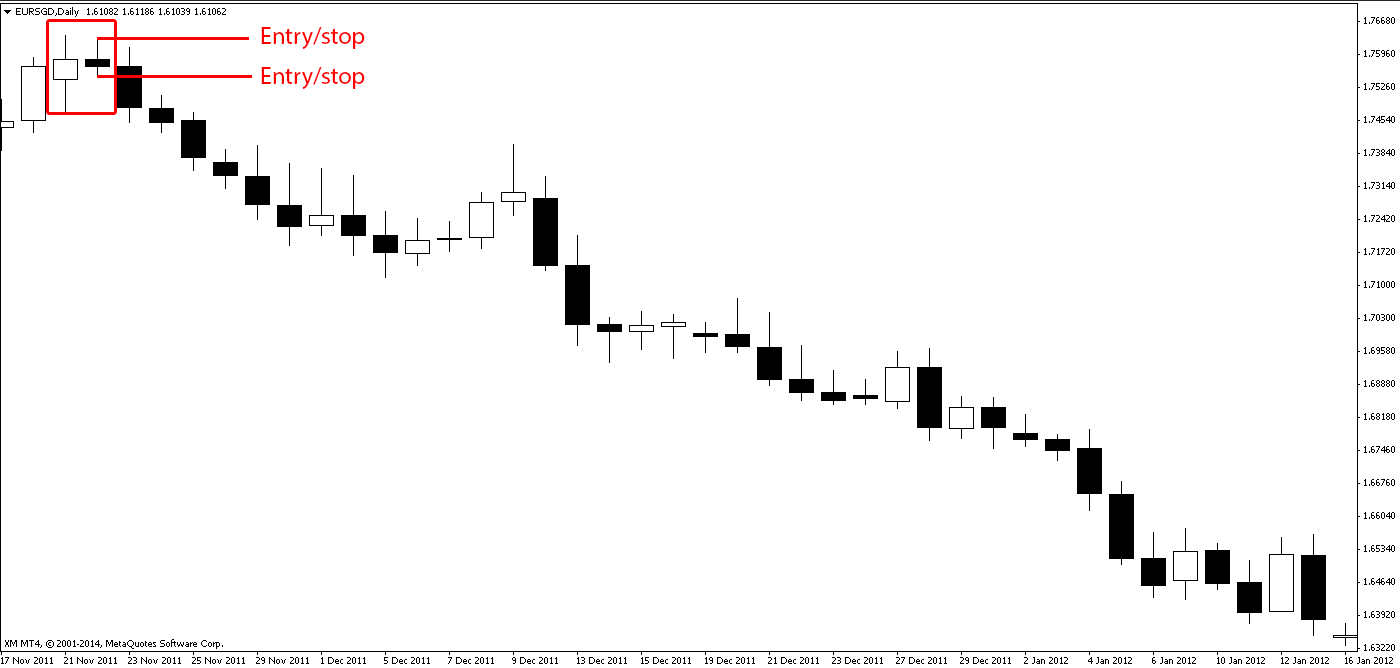

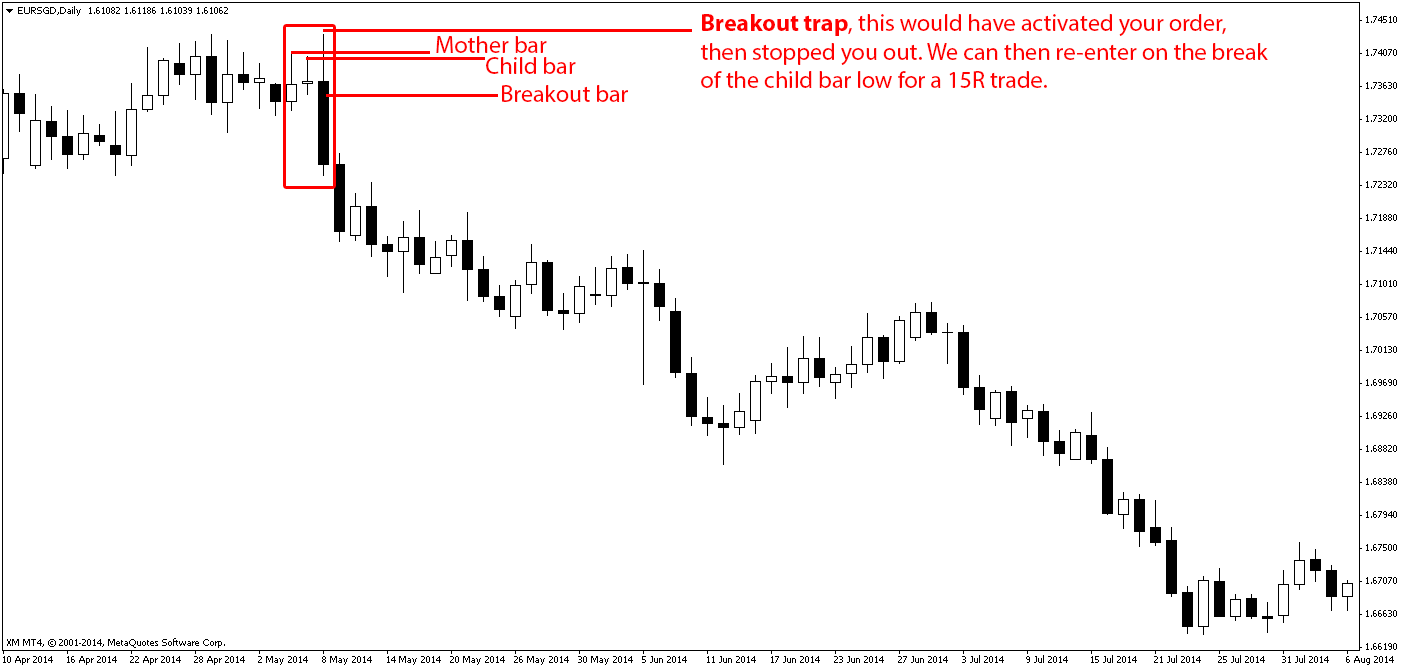

Inside bar breakout trap

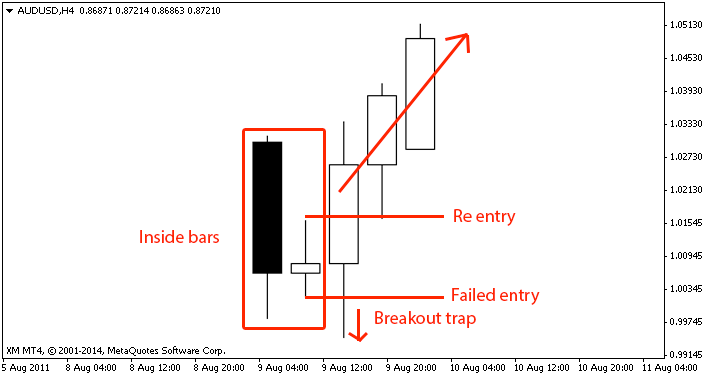

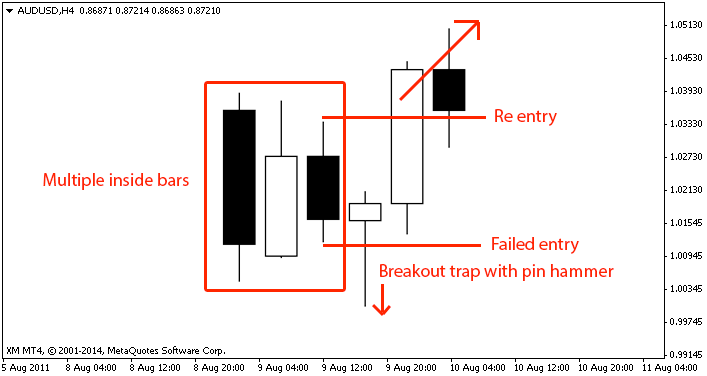

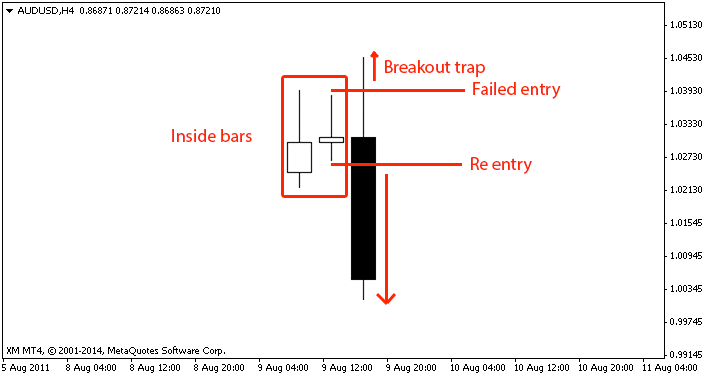

There is one other consideration, the inside bar breakout trap. This happens when the breakout goes one way triggering your order, and then reverses stopping you out. If this happens, it massively increases the probability of a decisive move in the opposite direction. You can either re-enter the trade in the new direction (the opposite direction of the last trade) with the same position size in the hope to break even, or double your original position size to aim for profits with the now increased probability. Breakout trap reversals can give very large risk rewards.

[Inside bar breakout trap with 15 times risk reward]

[Anatomy of the breakout trap, pending order is triggered and immediately the market turns against you. You can re enter the market in the new direction]

[Multiple inside bars, with pin hammer breakout trap]

[Simple re entry of the inside bar breakout trap can immediately recover your lost position. Double the position size to increase your profits]

The breakout trap is so effective because it takes advantage of a strange mathematical paradox. It’s a derivative of something called the ‘Monty Hall’ Problem (the market is the game show host, the choices are buy, sell and no trade, you can try and work the rest our self)! http://en.wikipedia.org/wiki/Monty_Hall_problem

Conservative entry: All examples shown are aggressive entry with breaks on the child bar, and like with all trades a dynamic and personal approach will serve you well so it’s worth knowing the other option. Which is simply to enter on break of the mother candle. This will give the trade a little more time to develop, but also requires a larger stop. Your stop has to be placed on the mother candle as well.

When to exit the inside bar

The exit will depend on your required risk reward and personal accuracy prediction, so make sure your keeping track with our free trading log. You can also exit when a reversal signal is presented, or a TSR level is breached.

Warnings

Inside bars are best used in trending or swing markets. Narrow ranges are not to be traded as they are a breeding ground for invalid inside bars. Remember, an inside bar is a signal the market is in consolidation or indecision. A ranging market is by default indecisive, neither the bears or bulls are winning over all, so an inside bar will not tell you anything new.

Also known as: Inside days

Pro tip: Most account draw downs (losses) are from counter trend trading, trade with the trend for maximum gains.